Table of Contents

What is Project Appraisal?

A project appraisal is a cost-benefit examination of several aspects of a proposed project with the goal of determining its viability. A project necessitates the use of limited resources. An entrepreneur must evaluate numerous potential ventures before committing precious resources to the best idea. The economic, financial, technical, commercial, management and social components of a project are all considered when evaluating it. Because of the capital investment that is usually required in every project, the impacts of a project appraisal are far-reaching and have very distinct long-term repercussions. Before lending money to a project, financial institutions conduct project appraisals to determine its creditworthiness.

Advantages of Project Appraisal?

This will allow for uniformity and impartiality in project selection.

Will make certain that their initiative helps all segments of the community.

Documentation will be provided to meet financial and audit obligations.

Justify the cost of a project.

It is a crucial decision-making tool.

The basis for project delivery is laid by appraisal.

What are the basic project appraisal methods?

- Net present value (NPV)

- Internal rate of return (IRR)

- Payback period

- Average rate of return

- Profitability index

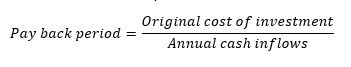

Payback period

The payback period is the amount of time required to recover the initial investment.

Under this strategy, the acceptance or rejection of an investment project is determined by its payback duration.

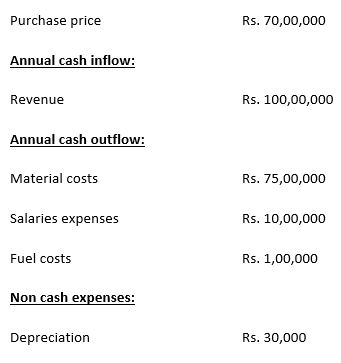

Example 1

ABC Catering decided to buy a van to distribute its products with the expectation that it would increase revenue. The usable life of a van is 8 years, and the company’s desired payback period is six years. The associated cash inflows and outflows are as follows. Check whether it is rational to purchase the van.

Answer

Investment = Rs. 70,00,000

Net cash inflow= Rs. (100,00,000 – 75,00,000 – 10,00,000 -1,00,000) = Rs. 14,00,000

Payback period = 70,00,000/14,00,000

= 5 years

Should acquire it, as the required payback period is less.

Also, keep in mind that the company’s intended payback period is six years, which is less than the van’s lifespan.

As depreciation is a non-cash item, it has not been accounted for when calculating net cash inflows and outflows.

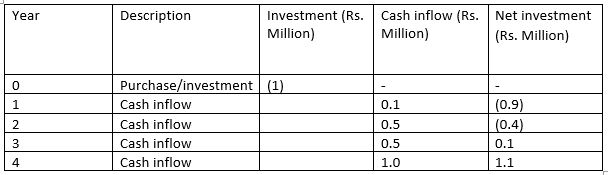

Example 2

PQR Pvt Ltd buys equipment for Rs 1 million. The annual cash inflows for the first four years are Rs., 0.1 million; 0.5 million; 0.5 million, and 1 million, respectively. The company’s expectation is to recoup the investment in two years. Can they do so?

Answer

The investment returns between the second and third years (2 & 1/5 years), thereby restricting the duration of the investment to two years.

Noting that cash inflows are strongly weighted toward the end of the time period, it is incorrect to calculate the payback period as 1 million / (average yearly cashflow) = 1 million / (2.1/4) = 1.9 years.

Advantages and disadvantages of the payback method:

Advantages

(1) Easy and straightforward

(2) Appropriate when the project is small

Disadvantages

(1) The cash flows after the payback period are not considered.

(2) Unsuitable for large projects.

(3) The emphasis is on liquidity rather than profitability.

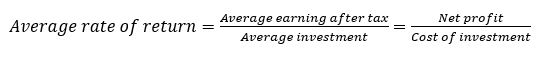

Return on investment (Average rate of return)

Return on investment (ROI) is a performance metric used to assess the efficiency or profitability of an investment or to compare the efficiency of several investments. ROI attempts to directly assess the amount of return on a certain investment in comparison to the cost of the investment.

Example 1

An investor buys Rs. 1 million worth of stocks and sells the shares two years later for Rs. 1.4 million. Calculate ROI

Answer

ROI = (1.4-1)/1 =0.4 = 40%

Advantages and disadvantages of ROI

Advantages

1) Considers all project earnings within its economic time (up to project completion).

(2) Relatively easy

(3) Consider both tax and depreciation.

Disadvantages

(1) The time worth of money is not considered.

(2) Because this is a ratio, the size of the investment is ignored.

(3) Profit reinvestment is not considered.

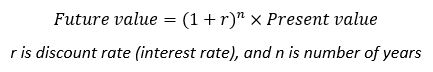

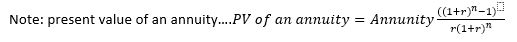

Net Present value (NPV)

The difference between the present value of cash inflows and the present value of cash withdrawals over time is the net present value (NPV). In capital budgeting and investment planning, NPV is used to assess the profitability of a proposed investment or project. The net present value (NPV) is the outcome of computations performed to determine the current present value of a future financing amount.

If the NPV is greater than zero, the project is viable (sign convention: + cash inflows; – cash outflows).

Example 1

The management is considering purchasing equipment to be attached to the main manufacturing machine. The equipment will cost 6,000 USD and will increase annual cash inflow by 2,200 USD. The useful life of the equipment is 6 years. After 6 years it will have no salvage value. The management wants a 20% return on all investments. Should the equipment be purchased according to NPV analysis?

Answer

1317 USD. Yes, they should buy it.

Example 2

An investor has an option to purchase a tract of land that will be worth 10,000 USD in six years. If the value of land increases 8% each year, how much should the investor be willing to pay now for this property?

Answer

PV = 10,000 (0.6302)

= 6302 USD

Advantages and disadvantages of NPV?

Advantages

(1) The time value of money is considered.

(2) The entire duration of the project is covered.

Disadvantages

(1) Calculation can be challenging.

(2) The impact of non-financial activities such as marketability is not taken into account.

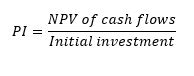

Profitability index (PI)

The profitability index (PI), also known as the value investment ratio (VIR) or profit investment ratio (PIR), is an indicator that indicates the relationship between a proposed project’s expenses and benefits. It is computed as the ratio of the present value of future predicted cash flows to the project’s initial investment. A higher PI indicates that a project is more appealing.

Advantages and disadvantages of PI?

Advantages

(1) The time value of money is taken into account.

(2) Various projects/options can be listed.

Disadvantages

Various interpretations.

Internal Rate of Return (IRR)

The internal rate of return (IRR) is a financial research indicator used to forecast the profitability of possible investments. In a discounted cash flow analysis, an IRR is a discount rate that reduces the net present value (NPV) of all cash flows to zero.

The same formula is used for IRR calculations as for NPV calculations. Remember that IRR is not the project’s actual financial value. The annual return is what causes the NPV to be zero.

In general, the higher the internal rate of return, the more attractive the investment. Because IRR is consistent across investment kinds, it can be used to rank several prospective investments or projects on a pretty equitable basis. When considering investment options with similar features, the investment with the highest IRR is most likely the best.

Advantages and disadvantages of IRR

Advantages

- The time value of money has been considered.

Disadvantages

(1) Assumes IRR for reinvestment.